Novated Leasing

Save up to $10k PA on tax and achieve your ESG targets

What is Novated Leasing?

In simple terms, a Novated Lease is where the car payments and costs of running your new EV (such as tyres, servicing, insurance and registration) are bundled together and deducted from your pay before tax by your employer, hassle free, saving you time and money in the process. Your employer simply deducts the lease payment from your wage before tax, and you get to decarbonise your transport and access thousands of dollars worth of savings!

Whilst Novated Leases are available on used cars they normally provide the greatest value to drivers that are looking to get into a new car. And even more if that new car is now electric (the FBT exemption is not available for new petrol / diesel vehicles!)

Good Car Co can provide you access to some great EV's below, and once you have an idea of which EV you would like to take up, our carefully selected novated lease partner will look after you with all the lease and financing arrangements to make getting into your new EV as easy as possible.

How you'll save

- Let's say your fortnightly gross salary is $3,000. From that $3,000, the ATO deduct $670 in tax (22%) leaving you $2,330 to spend on your living expenses including the vehicle.

- If you finance a vehicle with the usual personal financing, you will be paying this and all running costs from the net $2,330 and still paying the full $670 of Tax .

- The new legislation allows you to Salary Package the finance (a novated lease) and running costs before paying any income tax.(And doesn't add any new sneaky ones)

- This is where a Novated Lease will package all the purchase, finance, insurance and running costs of your new EV up into one simple payment and be deducted prior to the above tax being taken out. This means in this example you save paying 22% tax on any of your vehicle costs. (More if you are on a higher tax rate)

- AND because these payments are salary packaged you also don't pay GST, this automatically saves you an additional 10% (GST) on all vehicle costs.

New cars only!

the FBT exemptions only apply for cars “first used and registered post July 1st 2022”. That means you need to get a new car or very low mileage used EV to qualify.

So if you have a desire to lease our imported EV's check the year of manufacturer carefully to make sure it is manufactured after 1 July 2022. If its older you can lease, but not get the FBT exemption.

What are the tax benefits?

Your new EV could be tax free and save you thousands through the latest benefits found in Novated Leasing!

Your new EV could be tax free and save you thousands through the latest benefits found in Novated Leasing!

Good Car Co is all about accelerating the decarbonisation of transport through providing greater affordability and access to more and more people. And we think this is one of the most exciting developments when it comes to securing new EV's.

Novated Leasing is a financial packaging solution for employees of companies that has been around for a while but has recently had some exciting new changes and incentives attached for more people to access greater benefits.

New tax laws now introduced mean that Electric Vehicles (EV's) priced under $84,916 are now 100% exempt from Fringe Benefits Tax (FBT). This means employees can pay for the finance and all running costs before tax is deducted from wages.

With these new changes to tax laws and current tax levels, its another way EV's become more affordable and achievable for many more Australians which is a great thing for decarbonising our transport.

Find out your potential savings with our quick and easy calculator below.

More on the benefits

- Novated leasing is setup as an arrangement between you and your employer where you pay your vehicle expenses before tax rather than the normal finance options where you pay for your personal vehicle from your after tax pay packet. This means your earnings are working better for you and in turn have more money each pay to do things other than paying for car expenses.

- Novated Leasing can provide individuals a real way in which to reduce your taxable income whilst still having the benefits up front of driving a new EV! (You should seek out financial advice to your specific circumstances).

- The convenience. Most expenses are bundled up in the Novated Lease payments that you pay before tax. This means you don’t have any more unexpected out of pocket expenses such as car service, insurance or registration - they're all included in the lease payment!

- But the biggest reason we can think of to consider EV Novated Leasing here at Good Car Co. is of course you get to do all this and receive benefits whilst making the shift to a cleaner transport option for your life and take real and positive climate action.

Calculate your payments and savings

Individual benefits may change from person to person. We always recommend you get your own financial advice.

Note Second hand cars made before July 2022 cannot claim the FBT exemption. So sorry our imported cars are mostly not available. For more information on the benefits of novated leasing, see more information below.

The cars on offer

Polestar 2

Standard Range Single Motor

from $185 per week*

*includes all running costs!

- 445-478km range

- 19” alloy wheels

- Heated seats

- Rain sensing wipers

- Google built in and Apple CarPlay

- Dual zone climate control

Polestar 2

Extended Range Single Motor

from $201 per week*

*includes all running costs!

- 515-551km range

- Premium Paint options

- Pilot Lite pack with blind spot alert, cross traffic alert, rear collision warning, adaptive cruise control, 360* camera, auto dimming side mirrors, park assist and LED fog lights

Polestar 2

Long Range Dual Motor AWD

from $215 per week*

*includes all running costs!

- 455-487km range

- Premium Paint options

- Pilot Lite pack with blind spot alert, cross traffic alert, rear collision warning, adaptive cruise control, 360* camera, auto dimming side mirrors, park assist and LED fog lights

A Novated Lease that gives back

As a social enterprise, we’re committed to making a better future for us all. We invest in community EV education programs and carbon reduction advocacy. It doesn’t stop there; 50% of our profits help fund other organisations taking positive climate action.

If you are an employer keen to offer Novated Leasing to your employees, and you already support a community & climate focused charity, let us know and we contribute there. If not, then each month we will support one of these two fantastic organisations who are doing amazing work.

Read more

Established in 2001 with $50 in the bank and a handful of committed volunteers, TLC have grown to be one of Tasmania's largest private landholders. Through their reserves, work with landowners and a revolving fund, TLC are helping to protect critical habitat for the unique array of Tasmanian plants and wildlife, many of which are found nowhere else in the world.

A contribution from Novated Lease vehicles delivered in the months January, March, May, July, September and November will support Tasmanian Land Conservancy.

Credit: Andy Townsend

Read more

Pollinate identify, train and develop local women entrepreneurs who serve hard to reach families living on less than US$1.90 a day. Women entrepreneurs earn respect and meaningful income and act as role models who raise awareness about better product alternatives.

A contribution from Novated Lease vehicles delivered in the months February, April, June, August, October and December will support Pollinate Group.

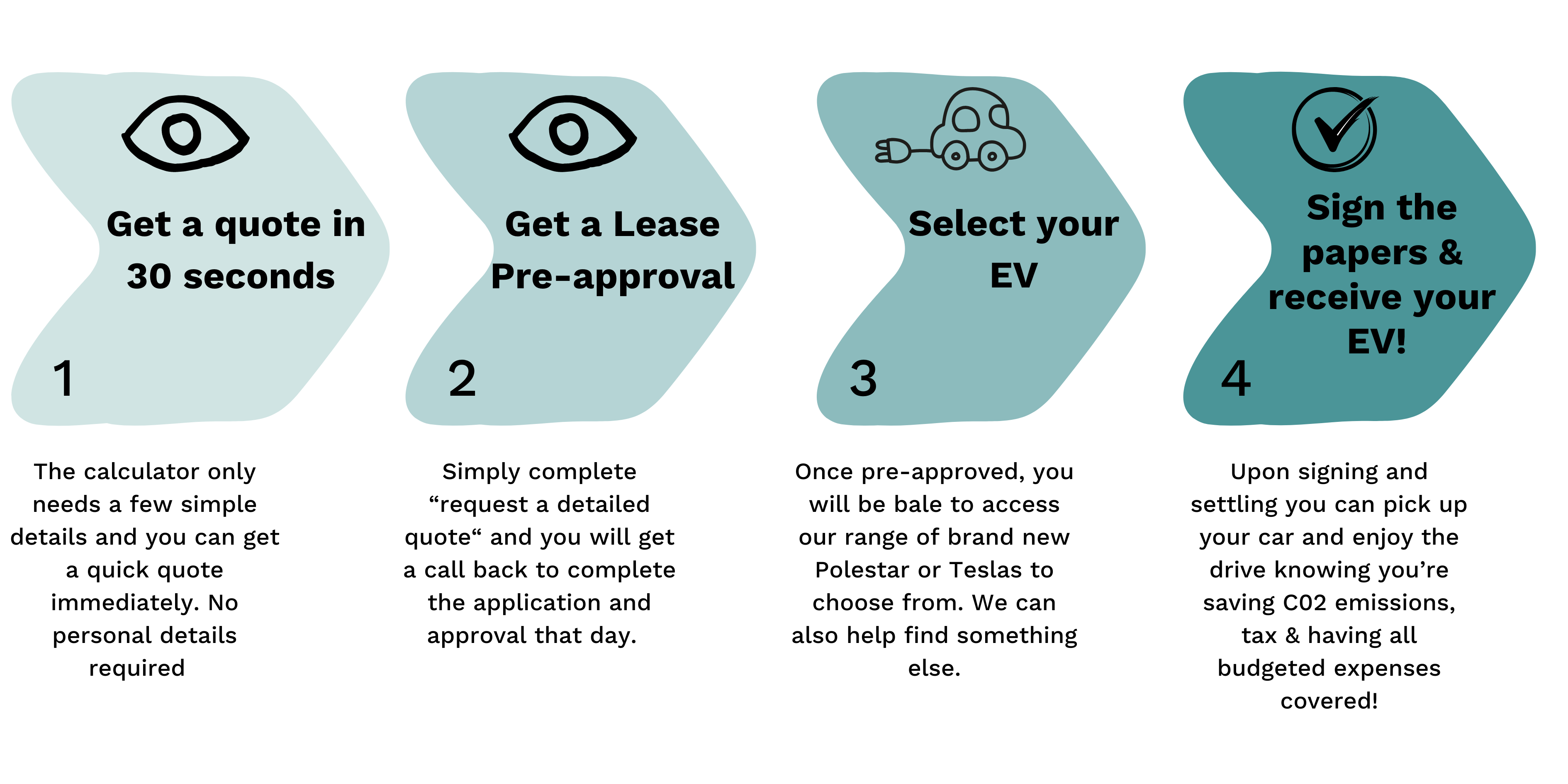

The process is simple

FAQs

What running costs are included in the lease?

Do I pay GST on the car?

What happens at the end of my lease?

Do I need to do anything at tax time?

Who is our Leasing Partner?

What happens if I leave my job?

- We can contact your new employer and discuss re-establishing your package with them.

- Your new employer may have already established a relationship with another Salary Packaging provider. We will cancel your package and transfer all money held with Vehicle Solutions Australia to the new provider or back to your current employer.

If your new employer does not want to take on your package, we simply cancel your package and you will be responsible to make all required payments in after tax income as you would have without salary packaging.

What running costs are included in the lease?

What running costs are included in the lease?

Who is our Leasing Partner?

Who is our Leasing Partner?

Do I pay GST on the car?

Do I pay GST on the car?

Do I need to do anything at tax time?

Do I need to do anything at tax time?

What happens at the end of my lease?

What happens at the end of my lease?

- paying out the residual value, keeping the car and owning the car outright

- trading the car in, paying out the residual value, then novate leasing a new car

- re-lease the residual value over a new term and keep the car

What happens if I leave my job?

What happens if I leave my job?

- We can contact your new employer and discuss re-establishing your package with them.

- Your new employer may have already established a relationship with another Salary Packaging provider. We will cancel your package and transfer all money held with Vehicle Solutions Australia to the new provider or back to your current employer.

If your new employer does not want to take on your package, we simply cancel your package and you will be responsible to make all required payments in after tax income as you would have without salary packaging.

I'm an Employee

Love the idea of leasing, but your workplace doesn’t offer it? We would love to help get your employer on board!

- It’s quick and easy for an employer to implement Novated Leasing

- We can help connect and setup any employer large or small

- Simply complete the below form and we’ll be in touch to help you, help your employer.

I’m an Employer

Thinking about offering your employees Novated Leasing for EV’s? We’d love to help!

- Become an employer of choice in the battle for talent!

- Add value for your team by offering affordable access to a range of electric vehicles

- Reduce your business’ carbon footprint and Scope 3 emissions on the path to Net Zero

- Simple onboarding process - 100% supported by Good Car Co and our leasing partner

Speak to one of our friendly expert team members

Call 03 6121 4624 Monday to Friday 9am - 5pm or email info@goodcar.co. Alternatively you can click the button below to request a callback from one of our team.